Login

Use LinkedIn or an email

Signup for free

Use LinkedIn or an email

Reset password

Enter email to reset password

"Earn the license that distinguishes you as a licensed tax practitioner"

Only designated CIBA members can apply to become a Licensed Tax Practitioner.

The license is built on competence, ethics, and professional tax standards and provides powerful support to accountants in practice.

Click here to view a summary of the admission criteria for the Licensed Tax Practitioner: Compiler & Advisor

CIBA Tax Practitioners have the exclusive offer to obtain a license to a Tax Knowledge Base at a hugely discounted fee:

- Normal price: R6,670.00 excluding VAT

- CIBA offer: R1,500 excluding VAT

- Saving of R5,170.00

The Tax Knowledge Base gives you access to 2,500+ corporate tax opinions prepared by master tax practitioners. The tax knowledge base is completely searchable and can be downloaded and presented to your clients.

This is a function typically found in-house of the Big Four Consulting firms.

See a demonstration below.

Recognised controlling body

CIBA was awarded the status of Recognised Controlling body (RCB) in terms of Section 240A(2) of the Tax Administration Act on 27 May 2021 by SARS.

This means CIBA members are able to directly register with CIBA to obtain their tax practitioner status with SARS.

CIBA wants to ensure that CIBA members that also provide tax services to clients, are:

- competent and able to provide high quality services,

- accountable for the work they perform,

- committed to tax CPD,

- aware of their role and responsibility to clients, and society.

Our Licensed Tax Practitioner aims to achieve this.

Protecting the public interest

CIBA offers a comprehensive recognition platform for accounting and tax professionals. We have statutory recognition in terms of numerous statutes and regulations which allows our members to offer professional engagements to clients.

The ability to include or provide tax services to clients is a fundamental part of our competitive advantage as a professional body.

Section 240 of the Tax Administration Laws Amendment Act 21 of 2012 requires that every person (except certain groups specifically excluded) that either:

- Provides advice to another person with respect to the application of a Tax Act or

- Completes or assists in completing a tax return on behalf of another

must register as a tax practitioner with the South African Revenue Service (SARS) and a Recognised Controlling Body (RCB), or a body whose members fall under the jurisdiction of a controlling body.

Only registered tax practitioners are allowed to advise clients on their tax affairs or complete tax returns, for a fee. Accountants that provide these services without being registered as a tax practitioner with SARS, and a controlling body will be guilty of a criminal offense.

Accounting officers that specialise in tax

Accounting and Tax are two fundamental service lines within the accountancy profession, and require specialist focus and attention to detail.

Aligning our focus on improving the quality of accounting and tax standards means the public is protected from poor service.

- Pre-2021: The era of dual membership.

- Post-2021: CIBA as RCB.

CIBA and SAIT co-operated by way of a mutual recognition MOU allowing CIBA to be presented as the home of accounting officers and SAIT as the home of tax practitioners.

CIBA’s alliance with SAIT continues and members who hold a dual membership with CIBA and SAIT can continue as they prefer.

Members have the option to continue their dual membership with SAIT or to become licensed as a tax practitioner under CIBA as RCB.

As part of the RCB criteria set by SARS, CIBA must ensure that only qualified persons perform engagements as tax practitioners. We ensure compliance by requiring all designated members offering taxation services to also be licensed as tax practitioners.

Step 1: Accountant’s designation:

Accountants apply to CIBA directly for one of our 4 designations: BA(SA), CBA(SA), CFO(SA) and BAP(SA)

Step 2: CIBA designation with a tax license

Designated CIBA members that also provide tax services to clients will apply to CIBA to become a Licensed Tax Practitioner and pay an additional license fee.

Licensed Tax Practitioner

- BA(SA), Licensed Tax Practitioner: Compiler

- BAP(SA), Licensed Tax Practitioner: Advisor

- BAP(SA), Licensed Tax Practitioner: Master

Expected levels of performance per CIBA Tax License

| Licensed Tax Practitioner: Compiler | |||

| Licensed Tax Practitioner: Advisor | |||

| Licensed Tax Practitioner: Master |

The taxation services that accountants perform can be divided in general in two categories:

- Compile – To perform taxation calculations and to provide compliance support.

- Advice – To perform basic taxation planning services, provide general advice and views on tax matters affecting a client. This excludes tax specialist work.

CIBA’s taxation licenses are aligned with the expected levels of performance when rendering services. The expected levels of performance are defined as follows:

- Awareness – To be conscious of. The remembering of previously learned material, and the ability to grasp the meaning of material.

- Comprehension – The ability to understand. The ability to use learned material in new and concrete situations, and the ability to break down material into its component parts so that its organizational structure may be understood.

- Application – The ability to understand, interpret and apply. The ability to put parts together to form a new whole, and the ability to judge the value of material for a given purpose based on definite criteria.

What can each license do

Licensed Tax Practitioner: Compiler

- Overview

- preparing, reviewing and submitting tax returns,

- reviewing completed tax records,

- verifying and availing source documents,

- submitting tax objections, and

- managing SARS queries, audits and assessments prior to judicial involvement.

- Awarding requirements

- Business Accountant (SA) designation e.g. BCom plus 2 years experience,

- Qualification should include tax modules at a minimum NQF5 level (2nd year tax at University level),

- 1 additional year of unstructured tax work experience endorsed by a direct superior or manager e.g. BA(SA) requires 2 years, which includes at least 1 year tax experience

- Acknowledgement and commitment to SARS fit and proper requirements applicable to tax practitioners,

- Abiding by the terms and conditions set by CIBA including CPD,

- Successful completion of the CIBA license assessment.

The Tax Compiler provides general and less complex tax compliance and support services for individuals and other entities related to:

A member seeking a tax compiler license are required to meet the following minimum requirements:

Licensed Tax Practitioner: Advisor

- Overview

- preparing, reviewing and submitting tax returns,

- reviewing completed tax records,

- verifying and availing source documents,

- submitting tax objections,

- managing SARS queries, audits and assessments prior to judicial involvement.

- provide advice and planning, and

- Write tax opinions.

- Entry requirements

- Business Accountant in Practice (SA) designation e.g. BCom Financial Accounting plus 4 years relevant experience,

- Qualification should include tax modules at a minimum NQF7 level (3rd year tax at University level),

- 1 additional year of unstructured tax work experience endorsed by a direct superior or manager e.g. BAP(SA) requires 4 years, which includes at least 1 year tax experience,

- Acknowledgement and commitment to SARS fit and proper requirements applicable to tax practitioners.

- Abiding by the terms and conditions set by CIBA including CPD,

- Successful completion of the CIBA license assessment.

The Tax Advisor’s level of expertise surpasses the Tax Compiler. The Tax Advisor has extensive experience and expertise in the industry with a thorough understanding of tax law and provides services, over and above the Tax Compiler duties and provides services for individuals with complex business structures, trusts and businesses of large sizes, relating to corporate, personal, value-added and payroll taxation:

A member seeking a tax advisor license are required to meet the following minimum requirements:

Licensed Tax Practitioner: Master

- Overview

- Manage corporate taxation matters of significant complexity;

- Represent taxpayers in court,

- Write specialised tax opinions and

- Mediate tax disputes.

- Entry requirements

The Tax Master’s level of expertise surpasses the Tax Advisor. The Tax Master provides services, over and above the Tax Advisor duties, such as:

CIBA issued this license once a person has obtained the Master Tax Practitioner designation with SAIT.

As prescribed by SAIT.

Similar status and authority

The licenses provide the same status and authority to provide tax services to clients similar to other RCBs as recognized by SARS.

Purpose of the license

To ensure accountants providing tax services:

- consist of the required taxation knowledge,

- have awareness of CIBA’s Statement of Standards on Tax and

- are committed to professionalism.

A summary of the CIBA tax licenses

CIBA tax licenses demonstrate the competency level of a CIBA designation holder to either compile or advise on tax related matters, and assess the practitioner's commitment to providing ethical tax services.

After completing this license the designated member will be able to:

- Identify the appropriate standards applicable in providing tax services

- Promote their uniform application within a tax firm.

- Understanding of members responsibilities when performing tax services.

- Foster increased public compliance with and confidence in our tax system through awareness of good standards of tax practice.

- Enhance the business accountant professional designations.

- Understand CIBA’s Statement of Standards on Tax

- Be able to apply with SARS as a tax practitioner.

- Understand the licensee’s responsibility when performing tax services.

- Use the license as proof of competency.

Topics covered in the license

It will be required to complete a declaration before access is provided to the learning material and assessment.

Learning Material

- CIBA’s Statement of Standards on Tax aligns with the code of conduct, quality control, and engagement standards as issued by the International Federation of Accountants (IFAC), and includes the following sections:

- General Standards

- Ethics and ethical constraints

- Personal competencies and skillset

- Non-compliance with laws and regulations

- 2. Standards of Engagement Performance

- Client and engagement acceptances and continuation, and management of risk

- Quality deliverables

- Form and content of advice to taxpayers

- Engagement hand over to other tax professional

- Standards of interaction with 3rd parties, including knowledge of error & confidentiality.

- Standards Governing Referral.

- Evaluation of involvement of external specialist

- Briefing pack preparation

- Webinar on:

- Introduction to CIBA’s Statement of Standards on Tax

- The difference between advice and a formal opinion and how to involve a Tax Master when their services are required.

- Assessments

Members will be required to complete 1 or 2 Assessments, based on their qualifications and experience.

Assessment 1 will assess the members knowledge regarding the CIBA Standards of Tax Statements.

Assessment 2 will assess the members Technical Skill relating to VAT, Corporate, Individual and Payroll Taxes.

In order to succeed, members are required to obtain at least 70% to pass. Members will receive 2 attempts to successfully complete the assessment/s.

On the successful completion of the assessment, a certificate will be issued.

The above assessment is a once-off examination.

Click here to view a summary of the admission criteria for the Licensed Tax Practitioner: Compiler & Advisor

Why a tax license is required

Accountants are trusted by society to perform their work competently and to the highest ethical standards.

That is why CIBA require its designated members to annually commit to:

- an annual practice licence (only BAP(SA)), and

- ethical assessment (all designations).

All of these assessment are grounded in the code of conduct, quality control, and engagement standards as issued by the International Federation of Accountants (IFAC).

In addition our members that perform tax services are also required to obtain:

- a tax practitioner license

Statement of Standards on Tax

CIBA’s Statement of Standards on Tax was drafted by independent Subject Matter Experts and approved by CIBA’s Technical Reference Group. They set forth tax practice standards and best practices that CIBA considered appropriate for its members performing tax services in South Africa.

CIBA's Statement of Standards on Tax is intended to complement other standards of tax practice, such as issued by SARS or issued in terms of the Tax Administration Act; and IFAC and CIBA issued accountancy rules.

CIBA's Statement of Standards on Tax is published in CIBA's Practice Support Library, under the Tax Practitioner category

Interpretation key

The Statement of Standards on Tax is written in as simple and objective a manner as possible. However, by their nature, practice standards provide for an appropriate range of behaviour and need to be interpreted to address a broad range of personal and professional situations.

The Statement of Standards on Tax recognizes this need by, in some sections, providing relatively subjective rules and by leaving certain terms undefined. These terms are generally rooted in tax concepts and, therefore, should be readily understood by tax practitioners working within the South African context.

Accordingly, enforcement of the Statement of Standards on Tax will be undertaken on a case-by-case basis. Members are however expected to use their best effort comply with them.

If you do tax you have to be licensed

The following are ideal candidates to apply for a CIBA Tax License:

- accountants performing taxation services,

- accountants who would like to qualify as a SARS Tax Practitioner,

- tax attorneys,

- public officers of companies, and

- SARS officials.

In terms of Section 240 of the Tax Administration Act No. 28 of 2011 every natural person who provides advice to another person with respect to the application of a tax; or completes or assists in completing a tax return, such person must register with or fall under the jurisdiction of a Recognized Controlling Body registered with the South African Revenue Services (SARS).

There is no restriction on the tax work which may be undertaken by a Licensed Tax Practitioner provided that the practitioner is competent to perform such function.

What you need to do before applying for the license

All RCB are mandated by SARS to require he following from their applicants.

Before you attempt the assessment to obtain your license you need to declare the following:

- you are a member of CIBA and meet the entry requirements;

- you are in good standing meaning;

- during the preceding 5 (five) years, you have not been removed from a related profession by a Controlling Body for serious misconduct;

- during the preceding 5 (five) years, you have not been convicted (whether in the Republic or elsewhere) of: theft, fraud, forgery or uttering a forged document, perjury or an offence under the Prevention and Combating of Corrupt Activities Act, 12 of 2004; or any other offence involving dishonesty, for which you have been sentenced to a period of imprisonment exceeding 2 (two) years without the option of a fine or to a fine exceeding the amount prescribed in the adjustment of Fines Act, 101 of 1991;

- during the preceding 5 (five) years, you have not been convicted of a serious tax offence or been deregistered by SARS as a Tax Practitioner;

- all information provided in your Application, and any supporting documentation attached thereto or submitted in conjunction therewith, is true and correct in all respects; and

- in considering your Application, CIBA shall be entitled to rely on the truth and accuracy of the information and supporting documentation provided by you at face value.

- you undertake to deliver to CIBA the original of any document referred to in or attached to your Application;

- You irrevocably consent to and authorise:

- CIBA to disclose any information and/or supporting documentation referred to in or attached to your Application to SARS;

- CIBA, to, at any time, conduct such background checks or verification checks as CIBA deems necessary to verify the accuracy and/or correctness of any information and/or supporting documentation referred to in or attached to your Application; and

- any entity and/or organisation, including but not limited to any University and/or Technicon and/or employer, to provide any and all information and co-operation as may be necessary to enable CIBA to verify the accuracy and correctness of any information and/or supporting documentation referred to in or attached to your Application.

- You undertake to notify CIBA in writing should any information in your Application change for any reason whatsoever or any of the declarations contained in the application no longer hold true and correct in all respects.

- You acknowledge and agree that:

- by virtue of your membership with CIBA, you are bound by and subject to the provisions of CIBA’s memorandum of incorporation, code of conduct and disciplinary procedures, as amended from time to time and/or as determined by CIBA from time to time, copies of which are available on CIBA’s website, www.saiba.org.za;

- you have read and are familiar with the above documents;

- should any of the information and/or supporting documentation referred to in or attached to your Application prove to be inaccurate and/or false and/or misleading, you may be subject to disciplinary sanction including, but not necessarily limited to the imposition of a fine up to R10,000-00 (ten thousand Rand) together with all costs incurred by CIBA in verifying the correctness of any information and/or supporting document submitted by you in your Application.

- once CIBA has verified your Application and you have successfully completed the required assesment/s,you will be issued with a Licence, entitling you to all the benefits and recognition relating to such registration.

- as a member of CIBA, you are bound by the conduct and engagement standards contained in the Handbook of the Code of Ethics for Professional Accountants as issued by the International Ethics Standards Board (IESB) for Accountants and the International Auditing and Assurance Standards Board (IAASB) Handbook of International Quality Control, Auditing, Review and Other Assurance and Related Services Pronouncements.

- You undertake as a Tax Practitioner to at all times:

- attain and maintain knowledge and skills relevant to the services provided to your clients;

- apply reasonable care, skill, and diligence in understanding how your client funds his/her lifestyle, and ascertaining your client’s state of affairs, to the extent that ascertaining the state of those affairs is relevant to a statement being made by you on behalf of your client;

- ensure that taxation laws are applied correctly and lawfully to the circumstances of your particular client;

- not knowingly obstruct the proper administration of the tax laws;

- ensure that you advise your clients of their rights and obligations under the tax laws of South Africa;

- exercise due diligence and care in your interactions with SARS on behalf of your clients;

- charge fees for work undertaken by you on behalf of your client commensurate with the nature and complexity of the task at hand; and

- not to charge a contingency fee for the completion of tax returns and to consider the principles of the Contingency Fees Act, 1997, when agreeing a contingency fee with clients in all other circumstances.

- You acknowledge and agree that:

- should you fail to comply with any provisions of these Terms, CIBA’s memorandum of incorporation and/or code of conduct and/or standards of engagements, you will be subjected to CIBA’s disciplinary procedures, which may result in: suspension or termination or suspension of your membership with CIBA, CIBA designation and/or Licence; civil and/or criminal prosecution; reporting such conduct to all relevant authorities, including SARS; the imposition of fines, penalties or other charges by CIBA; and in the event of termination of your membership with CIBA, CIBA designation and/or Licence, publication of your identity and sanction on CIBA’s website.

- You undertake for the duration of your registration as a Tax Practitioner to complete a minimum of 15 tax related CPD points (e.g. 15 points is equal to 15 hours but calculated based on output or competency assessments in the form of short multiple choice questions) per calendar year, of which:

- 60% (sixty percent) must be verified by CIBA;

- 40% (forty percent) may be non-verifiable.

Branded, secure, and verifiable digital certificates

- Obtain branded, secure, and verifiable digital certificates and badges.

- Your certificates can't be duplicated or faked.

- With a single click, you and potential clients/employers can verify the achievement is legitimate.

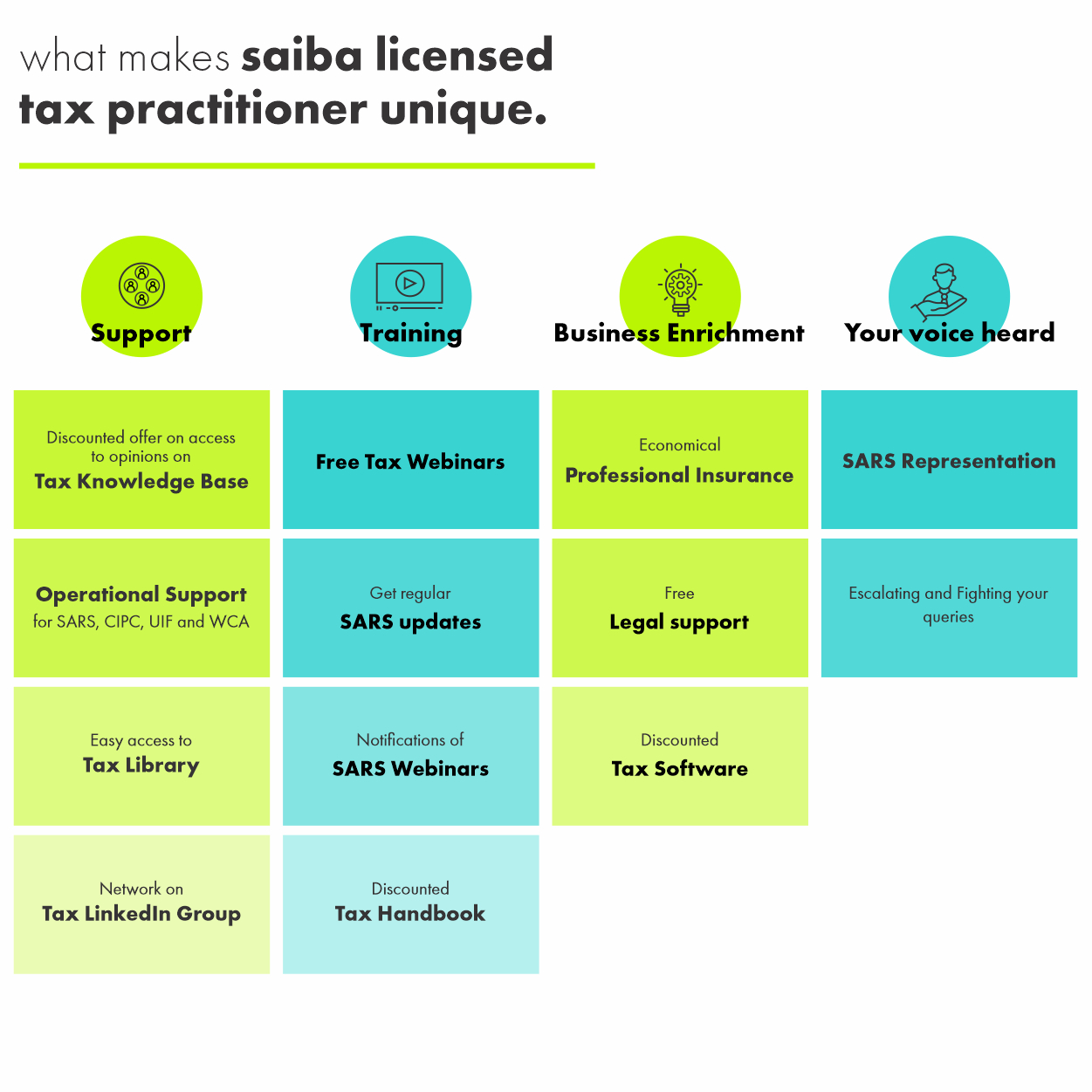

Advantages of obtaining a CIBA Tax License

CIBA rewards members for their ethical conduct. In addition to the rewards associated with a designation, CIBA tax practitioner license holders are also allocated the following rewards:

- Discounted offer on Tax Knowledge Base. The Tax Knowledge Base provides access to 2,500+ corporate tax opinions prepared master tax practitioners. Fully searchable and can be downloaded and presented to your clients. Charge an additional fee by offering clients tax opinions using the tax knowledge base

- SARS, UIF, Compensation Fund system operational support provided by a BAP(SA). License holders should submit their queries through technical@saiba.org.za. This is not an intime solution, and queries are used to create a best practice library to provide guidance on operational matters

- Monthly communication and updates on tax topics.

- Informal discussions and chats between licensed tax practitioners to share best practice, ideas and opportunities.

- Representation on the SARS Operational Stakeholder Committee. System problems experienced by licensed tax practitioners are collected and shared with SARS to ensure system improvements over time.

Below you can see a demonstration of how easy it is to navigate the tax knowledge base.

License Fee

| Licensed Tax Practitioner: Compiler | ||

| Licensed Tax Practitioner: Advisor |

How to join the CIBA Licensed Tax Practitioner Community

For the steps to become a CIBA Licensed Tax Practitioner click here.

Documentation

Documents required from members (not previously registered with other RCB’s).

- Registration Form on Membership system

- Identity Document

- Qualification Document

- Academic Record Document

- CV document

- Letter of Good Standing

- SARS Alignment form

- Declaration (form on membership system)

- Employment &Colleague Confirmation (*) or Schedule an Interview at a fee of R300.

- Self-Affirmation Form

- Tax Clearance Pin from SARS

- Marriage Certificate (if applicable)

- Police Clearance

(*) A confirmation letter is required for each one of your employers in the relevant period. CIBA has drafted a letter from our CEO to assist you with obtaining the confirmation letter, which explains the process and requirement.

Documents required for members previously registered with other RCB’s:

- Current RCB tax certificate

- Declaration

- Good Standing

- SARS Alignment form

- Tax Clearance Pin form

- Police Clearance

For further information regarding the documentation click here.

How to register with SARS as a Tax Practitioner

In order to register as a tax Practitioner:

- You must have an active tax reference number.

- Your name must reflect on the Taxpayer list, and

- You must be an Individual.

To register with SARS as a Tax Practitioner follow the instructions as listed here.

https://www.sars.gov.za/tax-practitioners/tax-practitioner-registration-process/

Get your license

Go to CIBA Academy and start to specialise.

Already a CIBA member?

Pre-register for your Licensed Tax Practitioner course today.

I am interested in becoming a CIBA Tax Practitioner